Jefferson County AR Tax Collector Property Search: A Comprehensive Guide

Are you looking to explore the property details in Jefferson County, Arkansas? The Jefferson County Tax Collector’s property search is an invaluable tool for anyone interested in real estate, whether you’re a potential buyer, investor, or simply curious about the properties in the area. In this detailed guide, we’ll walk you through the process of using the Jefferson County AR Tax Collector Property Search, highlighting its features and benefits.

How to Access the Jefferson County AR Tax Collector Property Search

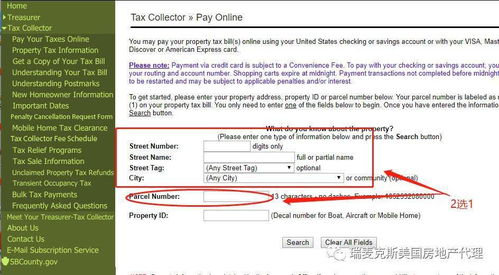

Accessing the Jefferson County AR Tax Collector Property Search is straightforward. Simply visit the official Jefferson County website and navigate to the “Property Search” section. You can find this by clicking on the “Real Estate” tab or using the search bar to look for “Jefferson County AR Property Search.” Once you’re there, you’ll be ready to explore the wealth of information available.

Search Options

The Jefferson County AR Tax Collector Property Search offers a variety of search options to help you find the information you need. Here are some of the key features:

- Address Search: Enter the property address to retrieve detailed information about the property, including owner names, assessed values, and property taxes.

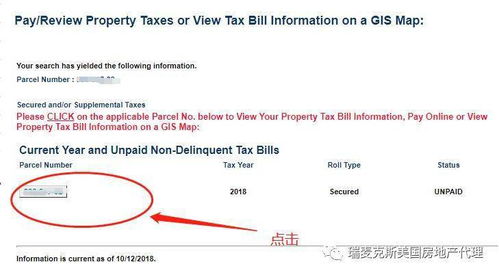

- Parcel ID Search: Use the parcel ID to find specific property details. This is particularly useful if you have the property’s identification number.

- Owner Search: Look up property information by the owner’s name. This can be helpful if you’re trying to track down a property owned by a particular individual or entity.

- Map Search: View properties on a map and filter results by various criteria, such as property type, assessed value, and ownership status.

Property Details

Once you’ve found the property you’re interested in, the Jefferson County AR Tax Collector Property Search provides a wealth of information. Here’s what you can expect to find:

- Owner Information: The name and contact information of the property owner, as well as any liens or judgments against the property.

- Assessed Value: The property’s assessed value, which is used to calculate property taxes.

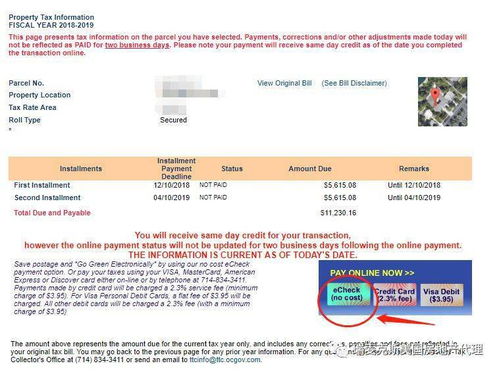

- Property Taxes: The current property tax amount, as well as any past due taxes or penalties.

- Parcel Information: The property’s legal description, including the parcel ID, zoning, and property type.

- Improvements: Information about any structures or improvements on the property, such as the number of bedrooms, bathrooms, and square footage.

- Maps and Photos: Visual representations of the property, including aerial views and photos of the property and surrounding area.

Understanding Property Taxes

Property taxes are an important aspect of owning real estate in Jefferson County. The Jefferson County AR Tax Collector Property Search provides detailed information about property taxes, including:

- Current Tax Amount: The amount of property tax due for the current fiscal year.

- Previous Tax Amounts: Historical tax information, including any changes in assessed value or tax rates.

- Payment Options: Information about how to pay property taxes, including due dates and payment methods.

Benefits of Using the Jefferson County AR Tax Collector Property Search

Using the Jefferson County AR Tax Collector Property Search offers several benefits:

- Convenience: Access property information from the comfort of your home or office.

- Accuracy: Rely on official records for the most accurate and up-to-date information.

- Time-Saving: Save time by avoiding trips to the tax collector’s office or waiting for mail.

- Cost-Effective: Access property information for free, without the need for a paid service.

Limitations and Tips

While the Jefferson County AR Tax Collector Property Search is a valuable tool, it’s important to be aware of its limitations:

- Not Always Current: Property information may not be updated immediately, so it’s essential to verify the accuracy of the data.

- Limited Historical Data: The search may not provide extensive