ar tx form 2020 pdf download: A Comprehensive Guide

Are you looking for the AR TX Form 2020 PDF download? If so, you’ve come to the right place. This guide will provide you with all the necessary information to obtain the form, understand its purpose, and ensure you complete it accurately. Let’s dive in!

What is the AR TX Form 2020?

The AR TX Form 2020 is a tax form used by individuals and businesses in Texas, United States, to file their state income taxes. It is similar to the federal Form 1040, but it is specific to Texas residents and businesses. The form is designed to help taxpayers calculate their taxable income, deductions, and credits, and determine the amount of tax they owe or are entitled to a refund.

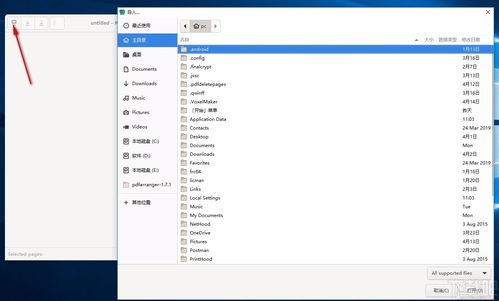

Where to Find the AR TX Form 2020 PDF Download

There are several ways to obtain the AR TX Form 2020 PDF download:

-

Visit the Texas Comptroller of Public Accounts website: https://comptroller.texas.gov/taxforms/2020/tx-1040.pdf

-

Download the form from a reputable tax preparation software provider, such as TurboTax or H&R Block.

-

Visit your local library or tax preparation office, where they may have copies of the form available for you to take home.

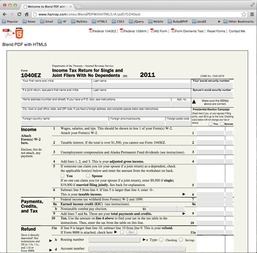

Completing the AR TX Form 2020

Completing the AR TX Form 2020 involves several steps. Here’s a brief overview:

-

Enter your personal information, including your name, Social Security number, and filing status.

-

Report your income, including wages, salaries, and other taxable income.

-

Claim any applicable deductions and credits, such as the standard deduction, child tax credit, and education credits.

-

Calculate your taxable income and determine the amount of tax you owe or are entitled to a refund.

-

Sign and date the form, and mail it to the Texas Comptroller of Public Accounts.

Understanding the AR TX Form 2020 Instructions

The AR TX Form 2020 instructions provide detailed guidance on how to complete the form. Here are some key points to keep in mind:

-

Read the instructions carefully before beginning to complete the form.

-

Follow the instructions step by step, and double-check your work to ensure accuracy.

-

Be aware of any changes to the form or tax laws that may affect your filing.

-

Keep copies of your completed form and any supporting documentation for your records.

Common Mistakes to Avoid When Completing the AR TX Form 2020

Here are some common mistakes to avoid when completing the AR TX Form 2020:

-

Misreporting income: Ensure you report all taxable income accurately.

-

Claiming incorrect deductions or credits: Review the instructions and ensure you are eligible for the deductions and credits you are claiming.

-

Not signing the form: Your signature is required to validate your return.

-

Missing deadlines: Be aware of the filing deadlines and submit your return on time to avoid penalties and interest.

Table: AR TX Form 2020 Key Components

| Component | Description |

|---|---|

| Personal Information | Includes name, Social Security number, and filing status. |

| Income | Reports wages, salaries, and other taxable income. |

| Deductions | Claims the standard deduction and other applicable deductions. |

| Credits

|