Understanding AR Crypto Price Prediction: A Detailed Guide for You

Are you intrigued by the world of cryptocurrencies and looking to dive into the realm of AR crypto price prediction? Well, you’ve come to the right place. In this comprehensive guide, we will explore the intricacies of AR crypto price prediction, providing you with a multi-dimensional understanding of the subject. Whether you are a seasoned investor or a beginner, this article will equip you with the knowledge to make informed decisions in the crypto market.

What is AR Crypto Price Prediction?

AR crypto price prediction refers to the process of forecasting the future value of cryptocurrencies using advanced analytical techniques. It involves analyzing historical data, market trends, and various factors that can influence the price of digital currencies. By understanding these factors, you can make more accurate predictions and potentially profit from your investments.

Historical Data Analysis

One of the key components of AR crypto price prediction is the analysis of historical data. This involves examining past price movements, trading volumes, and other relevant metrics. By studying historical patterns, you can identify trends and patterns that may repeat in the future. Here’s a breakdown of the types of historical data you should consider:

-

Price Data: Analyzing the historical price of a cryptocurrency can help you understand its volatility and potential growth or decline.

-

Trading Volume: Tracking trading volume can indicate the level of interest and activity in a particular cryptocurrency, which can be a good indicator of its future performance.

-

Market Cap: The market capitalization of a cryptocurrency reflects its overall value and can be a useful metric for predicting its future price.

Market Trends

Understanding market trends is crucial for AR crypto price prediction. These trends can be influenced by various factors, such as global economic conditions, regulatory news, technological advancements, and market sentiment. Here are some key trends to consider:

-

Economic Factors: Economic indicators, such as GDP growth, inflation rates, and interest rates, can impact the overall market sentiment and, consequently, the price of cryptocurrencies.

-

Regulatory News: Changes in regulations can significantly affect the crypto market. For example, a country’s decision to ban or regulate cryptocurrencies can lead to a surge or decline in prices.

-

Technological Advancements: Innovations in blockchain technology and the development of new cryptocurrencies can drive market trends and influence prices.

-

Market Sentiment: The overall sentiment of investors and traders can have a significant impact on the price of cryptocurrencies. Positive sentiment can lead to increased demand and higher prices, while negative sentiment can result in a sell-off and lower prices.

Technical Analysis

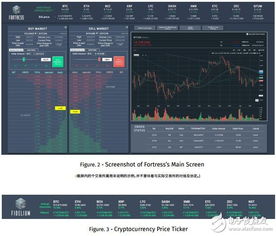

Technical analysis is a popular method used in AR crypto price prediction. It involves studying charts and graphs to identify patterns and trends that can indicate future price movements. Here are some common technical analysis tools and indicators:

-

Price Charts: Analyzing price charts can help you identify trends, support and resistance levels, and potential reversal points.

-

Volume Charts: Examining volume charts can provide insights into the level of interest and activity in a cryptocurrency.

-

Moving Averages: Moving averages are used to smooth out price data and identify trends. They can help you determine whether a cryptocurrency is in an uptrend or downtrend.

-

Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It can help you identify overbought or oversold conditions in a cryptocurrency.

Table: Common Technical Analysis Indicators

| Indicator | Description |

|---|---|

| Simple Moving Average (SMA) | Calculates the average price of a cryptocurrency over a specified period of time. |

| Exponential Moving Average (EMA) | Similar to SMA, but gives more weight to recent price data. |

| Bollinger Bands | Consists of a middle band being an SMA, with upper and lower bands that represent standard deviations from the middle band. |