Pope County Tax Collector Russellville AR: A Comprehensive Guide

When it comes to managing your taxes in Pope County, Arkansas, the Russellville Tax Collector is the go-to authority. This article will delve into the various aspects of the tax collector’s office, providing you with a detailed and multi-dimensional overview. From services offered to contact information, we’ve got you covered.

Services Offered

The Russellville Tax Collector’s office provides a range of services to ensure that residents and businesses in Pope County are compliant with their tax obligations. Here’s a breakdown of the services offered:

| Service | Description |

|---|---|

| Property Tax Collection | Collecting property taxes for the county and its municipalities. |

| Motor Vehicle Tax Collection | Collecting taxes on motor vehicles registered in Pope County. |

| Business Tax Collection | Collecting taxes on businesses operating within the county. |

| Personal Property Tax Collection | Collecting taxes on personal property owned by individuals and businesses. |

| Delinquent Tax Collection | Collecting taxes that are past due. |

| Assistance with Tax Payments | Providing guidance and assistance with tax payment options. |

Contact Information

For any inquiries or assistance, you can reach the Russellville Tax Collector’s office at the following contact details:

| Information | Details |

|---|---|

| Address | 100 East Main Street, Russellville, AR 72801 |

| Phone Number | (479) 968-6200 |

| Email Address | [email protected] |

| Office Hours | Monday to Friday, 8:00 AM to 4:30 PM |

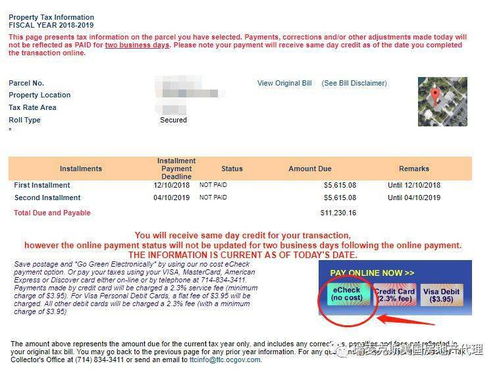

Property Tax Information

Property taxes in Pope County are based on the assessed value of your property. Here’s a breakdown of the property tax process:

-

Assessment: The county assessor determines the assessed value of your property.

-

Millage Rates: The county and its municipalities set millage rates, which determine the amount of tax you owe.

-

Property Tax Bill: You will receive a property tax bill from the tax collector’s office.

-

Payment Options: You can pay your property tax bill online, by mail, or in person.

Motor Vehicle Tax Information

Motor vehicle taxes in Pope County are based on the vehicle’s value and the number of months it is registered. Here’s how it works:

-

Vehicle Registration: When you register your vehicle, you will be charged a motor vehicle tax.

-

Monthly Tax: The tax is calculated based on the vehicle’s value and the number of months it is registered.

-

Renewal: You will need to renew your vehicle registration and pay the motor vehicle tax annually.

Business Tax Information

Business taxes in Pope County are based on the type of business and its gross receipts. Here’s what you need to know:

-

Business License: You will need to obtain a business license from the county.

-

Business Tax Rate: The tax rate