Understanding ar-Pay: A Comprehensive Guide

Are you curious about ar-Pay and how it works? Have you ever wondered what makes it different from other payment methods? Look no further, as this article delves into the intricacies of ar-Pay, providing you with a detailed and multi-dimensional overview.

What is ar-Pay?

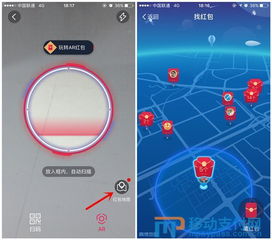

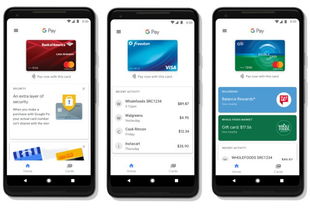

ar-Pay is an electronic payment service that allows users to make transactions using their mobile devices. It is a convenient and secure way to pay for goods and services, eliminating the need for cash or credit cards. By simply scanning a QR code or entering a payment code, you can complete a transaction in seconds.

How Does ar-Pay Work?

ar-Pay operates on a simple and straightforward principle. Here’s a step-by-step guide on how it works:

| Step | Description |

|---|---|

| 1 | Register for an ar-Pay account |

| 2 | Link your bank account or credit card to your ar-Pay account |

| 3 | Scan the QR code or enter the payment code at the point of sale |

| 4 | Confirm the transaction on your mobile device |

| 5 | Enjoy your purchase |

Benefits of ar-Pay

ar-Pay offers numerous benefits that make it a popular choice among consumers and businesses alike:

-

Convenience: With ar-Pay, you can make payments anytime, anywhere, as long as you have your mobile device.

-

Security: ar-Pay uses advanced encryption technology to protect your financial information, ensuring that your transactions are secure.

-

Speed: Transactions are processed quickly, allowing you to enjoy your purchase without any delays.

-

Accessibility: ar-Pay is available in many countries, making it a convenient payment option for travelers.

ar-Pay vs. Other Payment Methods

When comparing ar-Pay to other payment methods, such as credit cards or cash, there are several key differences:

-

No need for physical cards: ar-Pay eliminates the need for carrying cash or credit cards, reducing the risk of loss or theft.

-

Lower transaction fees: ar-Pay often offers lower transaction fees compared to credit cards, making it a cost-effective payment option for businesses.

-

Instant verification: ar-Pay uses real-time verification, ensuring that transactions are processed quickly and efficiently.

Is ar-Pay Safe?

Yes, ar-Pay is safe to use. The platform employs robust security measures to protect your financial information, including:

-

End-to-end encryption: Your payment information is encrypted throughout the transaction process, ensuring that it cannot be intercepted by unauthorized parties.

-

Two-factor authentication: ar-Pay requires a second form of authentication, such as a fingerprint or PIN, to complete a transaction, adding an extra layer of security.

-

Regular security updates: ar-Pay continuously updates its security protocols to protect against new threats and vulnerabilities.

ar-Pay in Different Countries

ar-Pay is available in many countries around the world, each with its own unique features and benefits:

-

China: ar-Pay is widely used in China, with millions of users enjoying its convenience and security.

-

Japan: ar-Pay has gained popularity in Japan, particularly among young consumers who prefer mobile payments.

-

South Korea: ar-Pay is also popular in South Korea, where it is used by both businesses and consumers.

-

India: ar-Pay has become a popular payment option in India, particularly in rural areas where traditional banking services are