Understanding Personal Property Tax AR: A Comprehensive Guide

Personal Property Tax AR, or Assessment Review, is a crucial process for individuals and businesses alike. It involves the evaluation and adjustment of property tax assessments to ensure accuracy and fairness. In this detailed guide, we will delve into the various aspects of Personal Property Tax AR, providing you with a comprehensive understanding of its significance and how it works.

What is Personal Property Tax AR?

Personal Property Tax AR is a review process that examines the assessed value of personal property for tax purposes. Personal property refers to items owned by individuals or businesses that are not permanently attached to land, such as vehicles, equipment, and furniture. The purpose of Personal Property Tax AR is to ensure that the assessed values accurately reflect the current market value of the property, thereby determining the appropriate tax liability.

Why is Personal Property Tax AR Important?

Personal Property Tax AR is essential for several reasons:

-

Ensures Fairness: By reviewing and adjusting assessments, Personal Property Tax AR helps ensure that property owners are not overpaying or underpaying taxes based on inaccurate assessments.

-

Prevents Tax Evasion: Personal Property Tax AR helps prevent tax evasion by ensuring that all property owners are paying their fair share of taxes.

-

Supports Local Government: Accurate property tax assessments provide local governments with the necessary revenue to fund public services and infrastructure projects.

How Does Personal Property Tax AR Work?

The Personal Property Tax AR process typically involves the following steps:

-

Assessment: Local tax assessors evaluate the value of personal property based on various factors, such as age, condition, and market value.

-

Notification: Property owners receive a notice of their property’s assessed value, along with instructions on how to request a review.

-

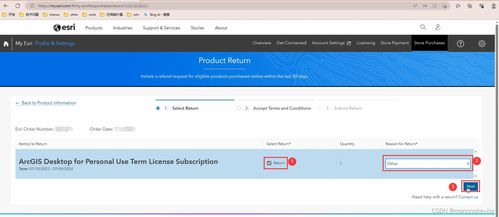

Review Request: Property owners who believe their assessment is inaccurate can request a review by submitting a formal appeal.

-

Assessment Review: A review panel or board examines the appeal, considering factors such as the property’s condition, market value, and comparable sales data.

-

Decision: The review panel or board makes a decision on the appeal, which may result in a revised assessment and tax liability.

Factors Affecting Personal Property Tax AR

Several factors can influence the outcome of a Personal Property Tax AR:

-

Market Conditions: Fluctuations in the real estate market can impact the assessed value of personal property.

-

Property Condition: The condition of the property, such as wear and tear or upgrades, can affect its assessed value.

-

Comparable Sales: The review panel or board considers comparable sales data to determine the market value of the property.

-

Local Tax Codes: Different jurisdictions have varying tax codes and assessment methods, which can impact the outcome of Personal Property Tax AR.

Challenges and Solutions in Personal Property Tax AR

Personal Property Tax AR can be challenging for both property owners and tax assessors. Here are some common challenges and potential solutions:

-

Challenge: Inaccurate or outdated information

-

Solution: Regularly update property records and conduct periodic reassessments to ensure accuracy.

-

Challenge: Lack of transparency in the assessment process

-

Solution: Provide clear guidelines and communication channels for property owners to understand the assessment process.

-

Challenge: High volume of appeals

-

Solution: Implement efficient appeal procedures and consider using technology to streamline the process.

Personal Property Tax AR in Different Jurisdictions

Personal Property Tax AR varies by jurisdiction, with different states and local governments having their own assessment methods and procedures. Here’s a brief overview of Personal Property Tax AR in some key jurisdictions:

| State | Assessment Method | Review Process |

|---|---|---|

| California |

|