Understanding AR and BR: A Comprehensive Guide

When it comes to analyzing stock market trends, two popular indicators that traders often turn to are the AR (Accumulation/Distribution) and BR (Bullish/Rising) indicators. These indicators provide insights into the market’s mood and potential price movements. In this article, we will delve into the details of AR and BR, exploring their calculations, interpretations, and practical applications.

What is AR (Accumulation/Distribution) Indicator?

The AR indicator, also known as the Accumulation/Distribution indicator, is a momentum indicator that measures the cumulative flow of money into and out of a security. It is based on the premise that price movements are influenced by the buying and selling pressure in the market. The AR indicator is calculated by dividing the sum of positive price changes by the sum of negative price changes over a specified period.

| Day | High | Low | Open | Close |

|---|---|---|---|---|

| Day 1 | 100 | 90 | 95 | 98 |

| Day 2 | 105 | 95 | 100 | 103 |

| Day 3 | 110 | 100 | 105 | 108 |

Using the data from the table above, we can calculate the AR indicator for Day 3 as follows:

AR (Day 3) = (High – Open) + (Close – Low) = (110 – 105) + (108 – 100) = 5 + 8 = 13

Interpreting the AR Indicator

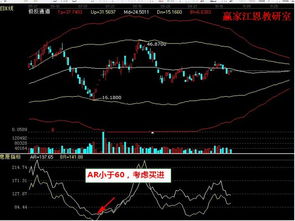

The AR indicator is typically used to identify the strength of a trend. A rising AR indicator suggests that buying pressure is increasing, indicating a bullish trend. Conversely, a falling AR indicator suggests that selling pressure is increasing, indicating a bearish trend. Traders often look for divergences between the AR indicator and the price to identify potential reversals.

What is BR (Bullish/Rising) Indicator?

The BR indicator, also known as the Bullish/Rising indicator, is a momentum indicator that measures the strength of a bullish trend. It is calculated by dividing the cumulative sum of the difference between the highest price of the day and the previous day’s closing price by the cumulative sum of the difference between the previous day’s closing price and the lowest price of the day.

Interpreting the BR Indicator

The BR indicator is used to identify the strength of a bullish trend. A rising BR indicator suggests that the trend is gaining momentum, indicating a potential for further price increases. Conversely, a falling BR indicator suggests that the trend is losing momentum, indicating a potential for price decreases. Traders often use the BR indicator in conjunction with other indicators to confirm their trading decisions.

Practical Applications of AR and BR Indicators

Traders can use the AR and BR indicators in various ways to inform their trading decisions:

-

Identify the strength of a trend: By analyzing the direction and magnitude of the AR and BR indicators, traders can determine the strength of a trend. A rising AR and BR indicator suggests a strong bullish trend, while a falling AR and BR indicator suggests a strong bearish trend.

-

Identify potential reversals: Traders can look for divergences between the AR and BR indicators and the price to identify potential reversals. For example, if the price is making new highs but the AR and BR indicators are not, it may indicate that the bullish trend is losing momentum and a reversal may be imminent.

-

Confirm trading decisions: Traders can use the AR and BR indicators to confirm their trading decisions. For example, if a trader is bullish on a stock, they may look for a rising AR and BR indicator to confirm their bullish outlook.

In conclusion, the AR and BR indicators are valuable tools for analyzing stock market trends. By understanding their calculations, interpretations, and practical applications