Understanding ar-Pay: A Comprehensive Guide

Are you curious about ar-Pay and how it works? Have you ever wondered what makes it different from other payment methods? Look no further, as this article delves into the intricacies of ar-Pay, providing you with a detailed and multi-dimensional overview.

What is ar-Pay?

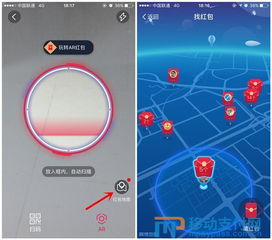

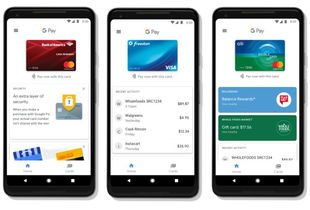

ar-Pay is an electronic payment service that allows users to make transactions using their mobile devices. It is a convenient and secure way to pay for goods and services, eliminating the need for cash or credit cards. By simply scanning a QR code or entering a payment code, you can complete a transaction in seconds.

How Does ar-Pay Work?

ar-Pay operates on a simple and straightforward principle. Here’s a step-by-step guide on how it works:

| Step | Description |

|---|---|

| 1 | Choose the payment method: You can select from various payment options, such as credit/debit cards, mobile wallets, or bank transfers. |

| 2 | Scan the QR code or enter the payment code: Once you’ve selected your payment method, you’ll need to scan the QR code or enter the payment code provided by the merchant. |

| 3 | Confirm the payment: After scanning the QR code or entering the payment code, you’ll be prompted to confirm the transaction. Make sure to double-check the amount before proceeding. |

| 4 | Transaction completed: Once the payment is confirmed, the transaction will be processed, and you’ll receive a confirmation message. |

Benefits of ar-Pay

ar-Pay offers numerous benefits that make it a popular choice among consumers and merchants alike:

- Convenience: ar-Pay allows you to make payments anytime, anywhere, as long as you have your mobile device with you.

- Security: ar-Pay employs advanced encryption and security measures to protect your financial information.

- Speed: Transactions are processed quickly, saving you time and effort.

- Accessibility: ar-Pay is available in many countries and supports multiple languages, making it accessible to a wide range of users.

ar-Pay vs. Other Payment Methods

When comparing ar-Pay to other payment methods, such as credit cards or cash, there are several key differences:

- Convenience: ar-Pay offers a more convenient payment experience, as it eliminates the need for physical cards or cash.

- Security: ar-Pay provides better security, as it uses advanced encryption and security measures to protect your financial information.

- Cost: ar-Pay may have lower transaction fees compared to credit cards, making it a more cost-effective option for merchants.

ar-Pay in Different Countries

ar-Pay is widely used in various countries around the world. Here’s a brief overview of its popularity in some key regions:

- Asia: ar-Pay is particularly popular in countries like China, Japan, and South Korea, where mobile payments are widely accepted.

- Europe: ar-Pay has gained traction in Europe, with many countries adopting mobile payment solutions.

- Americas: ar-Pay is slowly gaining popularity in the Americas, with more businesses and consumers embracing mobile payments.

Conclusion

ar-Pay is a convenient, secure, and efficient payment method that is changing the way we make transactions. By understanding its features and benefits, you can make informed decisions about using ar-Pay in your daily life.