SAP AR Aging Report by Invoice: A Comprehensive Guide

Managing accounts receivable (AR) is a crucial aspect of any business’s financial operations. Ensuring that invoices are paid on time and efficiently tracking the aging of receivables can significantly impact your company’s cash flow. SAP, being a leading enterprise resource planning (ERP) system, offers a robust solution to manage AR aging through its AR Aging Report by Invoice. This guide will delve into the various dimensions of this report, helping you understand its functionalities, benefits, and how to utilize it effectively.

Understanding the AR Aging Report by Invoice

The AR Aging Report by Invoice is a powerful tool within SAP that provides a detailed breakdown of your outstanding invoices. It categorizes invoices based on their due dates, helping you identify which invoices are due soon, past due, or overdue. This report is essential for financial planning, credit management, and maintaining healthy cash flow.

How the Report is Organized

The AR Aging Report by Invoice is typically organized in the following manner:

| Invoice Due Date Range | Number of Invoices | Invoice Amount |

|---|---|---|

| 0-30 Days | 100 | $10,000 |

| 31-60 Days | 200 | $20,000 |

| 61-90 Days | 300 | $30,000 |

| 91-120 Days | 400 | $40,000 |

| Over 120 Days | 500 | $50,000 |

This table illustrates how the report categorizes invoices based on their due dates, providing a clear picture of your AR aging.

Benefits of Using the AR Aging Report by Invoice

There are several benefits to utilizing the AR Aging Report by Invoice in your business:

- Improved Cash Flow Management: By identifying overdue invoices, you can take timely actions to collect payments, ensuring a steady cash flow.

- Enhanced Credit Management: The report helps you assess the creditworthiness of your customers and make informed decisions regarding credit limits.

- Effective Debt Collection: With a clear understanding of your AR aging, you can prioritize your debt collection efforts and focus on the most critical invoices.

- Accurate Financial Reporting: The report provides accurate and up-to-date information for financial reporting and analysis.

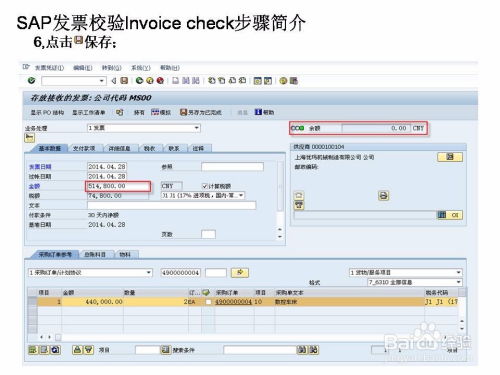

How to Generate the AR Aging Report by Invoice

Generating the AR Aging Report by Invoice in SAP is a straightforward process:

- Log in to your SAP system and navigate to the Financial Accounting (FI) module.

- Access the Accounts Receivable (AR) sub-module.

- Locate the “Aging Report” option and select it.

- Choose the “Invoice Aging Report” option.

- Select the desired date range and other relevant parameters.

- Click “Generate Report” to view the AR Aging Report by Invoice.

Once the report is generated, you can analyze the data, take necessary actions, and make informed decisions to improve your AR management.

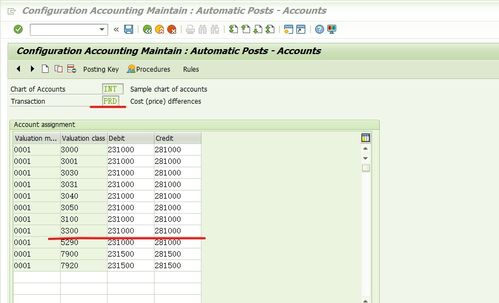

Customizing the AR Aging Report by Invoice

SAP allows you to customize the AR Aging Report by Invoice to suit your specific needs. Here are some customization options:

- Report Format: Choose from various report formats, such as PDF, Excel, or HTML.

- Sorting and Filtering: Sort and filter the report based on different criteria, such as customer, invoice date, or due date.

- Grouping: Group the report by customer, country, or any other relevant criteria.

- Custom Fields: Add custom fields to the report to display additional information.