Understanding the AR Refund Process: A Comprehensive Guide

When it comes to managing finances, especially in the realm of accounts receivable (AR), refunds are an inevitable part of the process. Whether it’s due to customer dissatisfaction, product defects, or simply a change of heart, refunds play a crucial role in maintaining customer satisfaction and trust. In this article, we’ll delve into the intricacies of the AR refund process, providing you with a detailed understanding of how it works and what you need to know.

What is an AR Refund?

An AR refund refers to the process of returning funds to a customer who has made a payment for a product or service. This can occur for various reasons, such as a cancelled order, a defective product, or a change in the customer’s needs. The refund process is an essential aspect of accounts receivable management, ensuring that customers are satisfied and that your business maintains a positive reputation.

The Steps of the AR Refund Process

The AR refund process typically involves several steps, each of which is crucial for ensuring a smooth and efficient transaction. Let’s take a closer look at these steps:

| Step | Description |

|---|---|

| 1. | Customer Initiation |

| 2. | Refund Request Review |

| 3. | Refund Approval |

| 4. | Refund Processing |

| 5. | Notification to Customer |

1. Customer Initiation: The process begins when a customer requests a refund. This can be done through various channels, such as phone, email, or an online portal.

2. Refund Request Review: Once the request is received, your team will review it to ensure it meets the criteria for a refund. This may involve checking the customer’s account history, the nature of the request, and any applicable policies.

3. Refund Approval: If the request is approved, the next step is to authorize the refund. This may involve obtaining approval from a supervisor or manager, depending on your company’s policies.

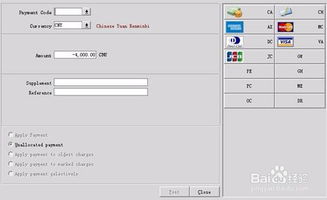

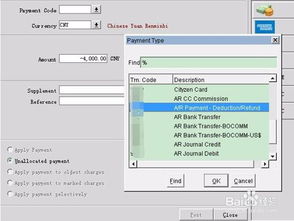

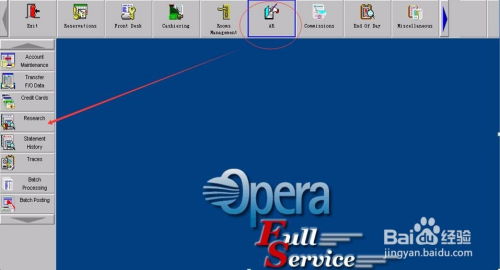

4. Refund Processing: Once approved, the refund is processed. This may involve updating the customer’s account, issuing a check, or initiating a bank transfer.

5. Notification to Customer: Finally, the customer is notified that the refund has been processed. This ensures that they are aware of the transaction and can verify the amount.

Common Challenges in the AR Refund Process

While the AR refund process is essential for customer satisfaction, it can also present challenges. Here are some common issues that businesses may encounter:

-

Inadequate documentation: Without proper documentation, it can be difficult to verify the customer’s request and ensure that the refund is processed correctly.

-

Complex policies: Confusing or complex refund policies can lead to misunderstandings and delays in the refund process.

-

Manual processing: Manual processing of refunds can be time-consuming and prone to errors, leading to customer dissatisfaction.

Best Practices for Managing AR Refunds

To ensure a smooth and efficient AR refund process, consider the following best practices:

-

Clear policies: Develop clear and concise refund policies that are easy for customers to understand.

-

Automated systems: Implement automated systems to streamline the refund process and reduce errors.

-

Training: Provide training for your team on the refund process and policies to ensure they are equipped to handle customer requests effectively.

-

Documentation: Maintain thorough documentation of each refund transaction to ensure accuracy and compliance.

In conclusion, the AR refund process is a critical aspect of accounts receivable management. By understanding the steps involved, addressing common challenges, and implementing best practices, you can ensure a smooth and efficient refund process that maintains customer satisfaction and trust.